In many companies, company credit cards used for travel expenses circulate from hand to hand like "public property". The card number is shared from WhatsApp groups, the security code (CVC) on the back is written on post-it notes. This situation is a major financial security vulnerability for companies. Also, it becomes impossible to track which expense was made by whom. Kurumsal.pro's Central Payment System allows you to make secure and controlled spending by hiding card information.

Risks Created by Card Sharing

Uncontrolled sharing of company credit card information poses the following risks:

- Unauthorized Spending: Someone with card information can make non-company expenses.

- Limit Exceeded: Everyone using the same card can cause the card limit to be filled at a critical moment and work to be disrupted.

- Accounting Chaos: There are hundreds of expense items in the statement arriving at the end of the month, but it is not clear which one belongs to whom.

Solution: Central Wallet

Kurumsal.pro stores company credit cards in a secure "digital wallet". Employees do not see the card number, they can only make payments using this wallet within the defined authorization.

How Does It Work?

1. Card Definition

The finance manager defines the company credit cards into the system once. These data are stored encrypted at bank level in PCI-DSS standards. The card number never appears openly again.

2. Authorization

Which department or which employee can use the company card is defined in the system. You can set rules like sales team can use the card but HR cannot.

3. Payment Moment

The employee selects the "Pay with Company Card" option at the payment step while booking. No need to enter card information. If approved, the transaction takes place.

4. Instant Reporting

As soon as the transaction is finished, spending information (User, Amount, Date, Service Type) is processed into the system. The question "Who spent from the card?" becomes history.

Frequently Asked Questions

Is there virtual card support?

Yes. If we have integration with your bank, we can maximize security by generating a unique "One-Time Virtual Card" number for each transaction.

Can I set a spending limit?

You can define monthly/yearly spending limits on a department or person basis. Card usage is automatically stopped when the limit is reached.

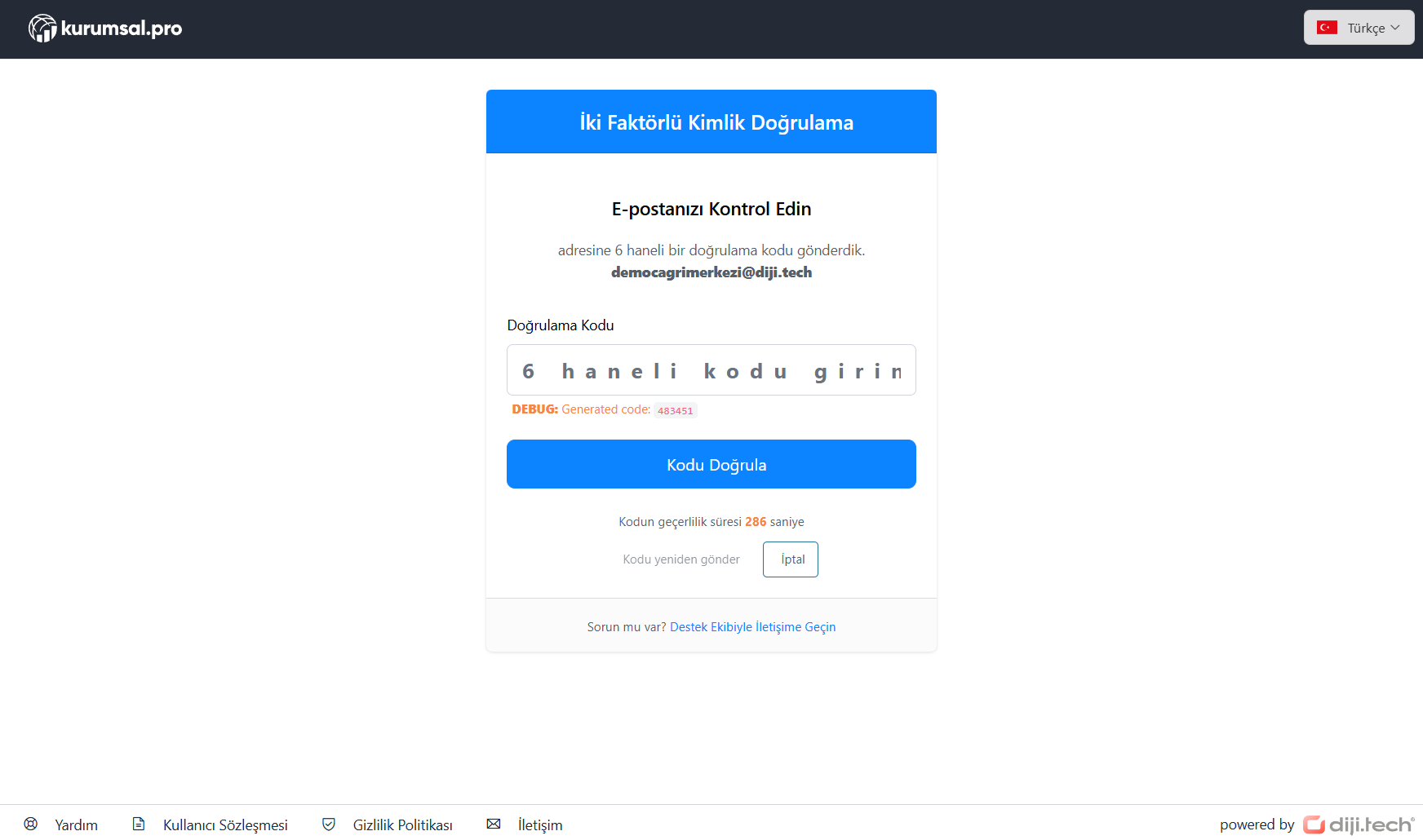

How is the 3D Secure transaction done?

The 3D Secure password goes to the mobile phone of the authorized person (usually the Finance Manager) where the card is defined. The transaction is not completed without this person entering the password. Or secure wallet structures like BKM Express are used.